Most B2B SaaS companies fail within their first two years, often due to poorly executed market entry strategies. The difference between success and failure frequently comes down to having a solid go-to-market strategy for B2B SaaS companies.

At JBI Consulting, we’ve seen how the right approach can accelerate growth from zero to millions in ARR. This guide breaks down the essential components that separate winning launches from costly mistakes.

Understanding Your B2B SaaS Market

Success starts with precision in customer identification. Most SaaS founders cast too wide a net and target everyone who might need their product instead of those most likely to buy and succeed. The data shows that top-performing B2B SaaS companies reach 1,000 subscribers in just 11 months, while median companies take 2 years. This speed difference stems from laser-focused targeting rather than broad market approaches.

Build Data-Driven Customer Profiles

Start with your existing users, not assumptions. Extract behavioral patterns from current customers who generate the highest lifetime value and lowest churn rates. Look at company size, industry verticals, technology stack, and decision-making processes. Companies with average sale prices below 0 often experience faster customer base growth due to shorter sales cycles, but they need volume to compensate. Higher-priced solutions require you to target decision-makers with budget authority and longer evaluation timelines.

Size Your Market Opportunity

Market size analysis requires bottom-up calculation, not top-down guesswork. Count actual companies that match your ideal profile within your geographic reach. Use tools like LinkedIn Sales Navigator or ZoomInfo to identify specific organizations that fit your criteria. Calculate realistic penetration rates based on similar products in adjacent markets. Over 80% of buyers finalize mid-market SaaS decisions within six months, which means your addressable market consists of companies that actively evaluate solutions, not passive prospects.

Test Product-Market Fit Early

Product-market fit validation happens through customer interviews, not surveys or analytics alone. Conduct 50-100 conversations with target prospects before you build features. Ask specific questions about current workflows, pain points, and budget allocation. Trial-to-paid conversions peak around day 7, which makes early user engagement metrics your primary validation signal. Companies that achieve strong product-market fit see trial conversion rates of 15-18% for B2C and 2.5% for B2B within the first week. Anything significantly below these benchmarks indicates misalignment between your solution and market needs.

With your target customer clearly defined and validated, the next step involves crafting compelling value propositions that resonate with each specific segment you’ve identified through your go-to-market strategy.

Building Your Go-to-Market Foundation

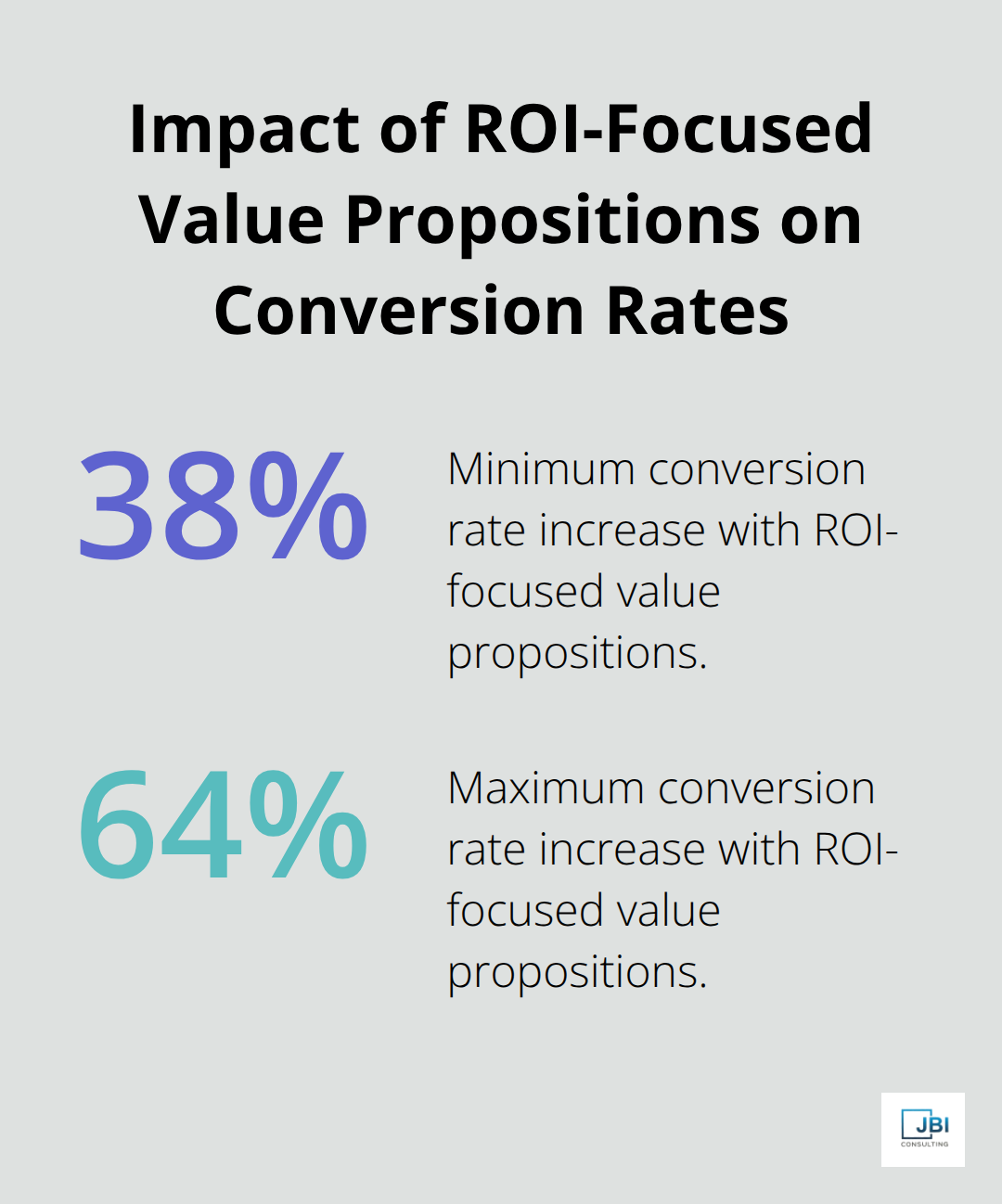

Your value proposition must speak directly to measurable business outcomes, not product features. Companies with clear value propositions tied to ROI see conversion rates increase by 38-64% compared to those that focus on functionality. For enterprise segments, frame your value around cost reduction and efficiency gains with specific dollar amounts. Mid-market clients respond better to time savings and competitive advantages. Small businesses need simple solutions that solve immediate pain points without extensive implementation requirements.

Slack succeeded when it positioned itself as a productivity multiplier rather than another messaging app. The company directly addressed workplace communication inefficiency that creates avoidable costs for businesses in the form of lost productivity.

Pricing Models That Accelerate Growth

Freemium strategies work for products with viral potential and low marginal costs, but require 95% of users to subsidize the 5% who convert. Companies with average sale prices below achieve 20% new business ARR growth through product-led approaches, while those that layer sales too early see 0% growth.

Usage-based pricing generates 38% more revenue than per-seat models for infrastructure products. Tiered pricing with clear value differentiation converts 3x better than single-price offers. HubSpot’s success stems from value-based pricing that scales with customer growth, not arbitrary feature limitations.

Channel Strategy for Maximum Impact

Inbound marketing drives 54% lower customer acquisition costs than outbound for horizontal SaaS products, but requires 12-18 months to generate a significant pipeline. Account-based marketing delivers 97% higher win rates for deals above $100K but demands tight sales and marketing alignment.

Partner channels contribute 30% of revenue for established SaaS companies, yet most startups ignore partnerships until they hit $10M ARR. LinkedIn generates 80% of B2B social leads, but organic reach dropped 60% since 2020. Employee advocacy programs amplify content reach by 561% compared to company pages.

Direct sales becomes profitable at $50K+ annual contract values, while inside sales works for $5K-$50K deals. Effective sales strategies become profitable at these thresholds. The foundation you establish here determines how effectively you can execute your go-to-market strategy and coordinate teams for maximum market impact.

Executing Your Launch Strategy

Launch execution separates successful SaaS companies from the 87% that fail to reach $10M ARR within 10 years. Beta programs generate 5x higher conversion rates than cold launches when you structure them correctly. Recruit 50-100 beta users who match your ideal customer profile exactly, not random volunteers. Notion grew from 1 million to 30 million users between 2019 and 2023 through community-led beta tests that created authentic product advocates.

Set specific metrics for beta participants: daily active usage above 40%, feature adoption across 3+ core functions, and Net Promoter Scores above 50. These benchmarks predict post-launch success better than vanity metrics like signup numbers.

Build Pre-Launch Momentum Through Strategic Beta Programs

Structure your beta program around value delivery, not feature feedback. Select participants who represent your highest-value customer segments and can provide detailed usage data. Loom achieved 1,100% revenue growth in 2020 by leveraging beta users who became vocal advocates during the pandemic shift to remote work.

Create exclusive access tiers that reward active participation. Beta users who complete specific tasks (like inviting team members or using advanced features) receive extended free access or premium support. This approach generates authentic testimonials and case studies before your official launch.

Align Sales and Marketing Teams for Maximum Impact

Revenue teams that share unified definitions of qualified leads see higher win rates than misaligned organizations. The average sales win rate in 2024 was 21%. Define Marketing Qualified Leads based on behavioral triggers, not demographic data. A prospect who visits pricing pages 3+ times and downloads comparison guides shows 8x higher purchase intent than someone who only reads blog posts.

Sales Qualified Leads require budget confirmation, a timeline within 90 days, and decision-maker access. Product Qualified Leads demonstrate value realization through specific in-app behaviors like completing onboarding sequences or inviting team members.

Implement weekly revenue meetings where marketing reports lead quality metrics while sales provides conversion feedback. This creates accountability loops that improve lead scoring accuracy by 40% within 60 days.

Deploy Multi-Channel Customer Acquisition

Multi-channel approaches generate 24% more qualified leads than single-channel strategies, but channel selection depends on your average sale price and customer segment. LinkedIn outbound works for enterprise deals above $50K annually, generating response rates of 15-20% with personalized messages.

Content marketing drives 62% of B2B leads for horizontal SaaS products, but requires 12-18 months to reach full effectiveness. Account-based marketing delivers 208% higher revenue impact for companies that target fewer than 1,000 accounts.

Focus on Day-One Retention Strategies

Retention strategies must start on day one, not after conversion. Companies that implement customer success programs during trials see 73% higher annual retention rates. Focus activation efforts on the first 7 days when trial-to-paid conversions peak (trial conversions drop significantly after the initial week for B2B products).

Maintain engagement through value-driven touchpoints every 30 days. AI tools now help automate onboarding sequences, with early adopters reporting 2x higher activation success and quicker time to value compared to manual processes.

Final Thoughts

A successful go-to-market strategy for B2B SaaS companies requires precision over broad approaches, data-driven customer profiles, and relentless focus on product-market fit validation. The companies that reach 1,000 subscribers in 11 months instead of 2 years execute these fundamentals flawlessly while they avoid common mistakes that derail launches. The biggest pitfalls include simultaneous pursuit of too many segments, premature sales process implementation for low-price products, and neglect of retention strategies during trial periods.

Companies that layer sales onto product-led growth models before they achieve strong conversion metrics see 0% new business ARR growth compared to 20% for those who maintain focus. Your next steps involve continuous optimization based on real user behavior, not assumptions. Monitor trial-to-paid conversion rates weekly, track customer acquisition costs by channel, and adjust price models based on actual sales cycle data (the most successful launches happen when teams maintain alignment around shared metrics and respond quickly to market feedback).

We at JBI Consulting help sales teams shift from passive lead nurture to proactive opportunity pursuit through proven methodologies that enhance client relationships and boost deal closure rates. The right sales approach amplifies even the strongest go-to-market foundation. Success depends on execution speed and market responsiveness rather than a perfect initial strategy.